IRS 8840 2025-2026 free printable template

Instructions and Help about IRS 8840

How to edit IRS 8840

How to fill out IRS 8840

Latest updates to IRS 8840

All You Need to Know About IRS 8840

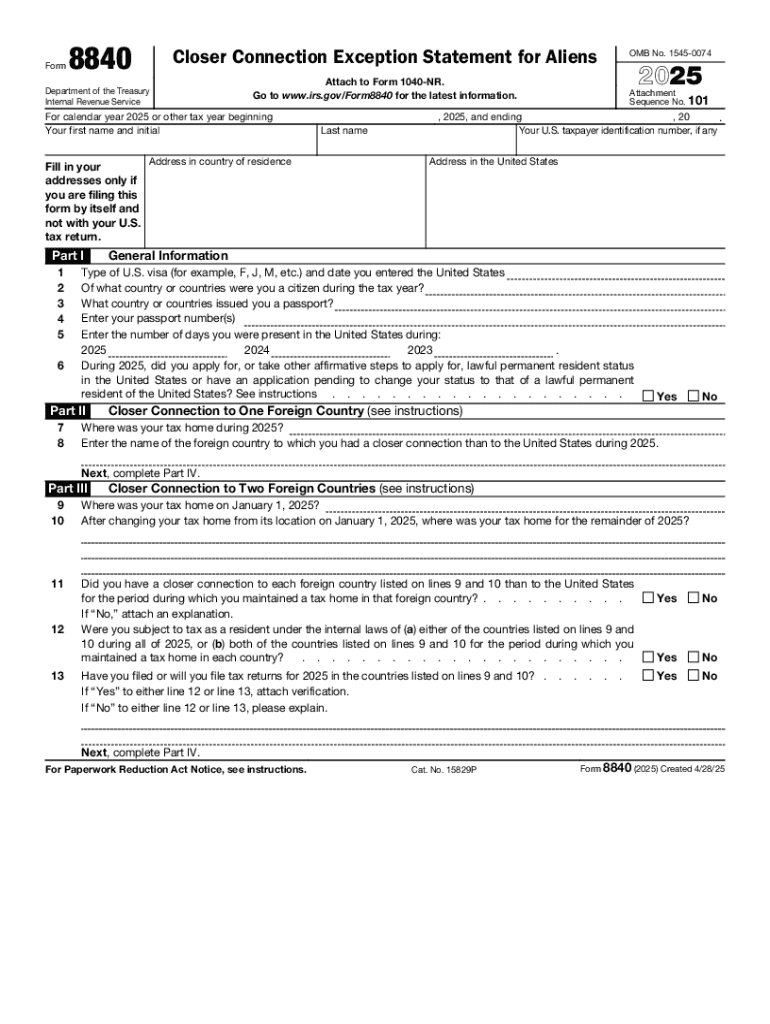

What is IRS 8840?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 8840

What should I do if I make a mistake after filing IRS 8840?

If you realize there's an error on your IRS 8840 after submission, you can correct it by submitting an amended form. It's important to indicate on the form that it is a correction and provide an explanation of the changes made. This helps ensure the IRS processes the correction smoothly and updates your records accordingly.

How can I track the status of my IRS 8840 after submission?

To track the status of your IRS 8840 after filing, you can use the IRS 'Where's My Refund?' tool if applicable or contact the IRS directly. Keep your submission confirmation handy, as it will help in verifying the processing status. Common rejection codes may also appear, so understanding those can aid in troubleshooting if issues arise.

Are there special considerations for filing IRS 8840 on behalf of someone else?

If you're filing IRS 8840 for someone else, ensure you have the proper authorization, such as a Power of Attorney (POA). This is necessary for the IRS to acknowledge your submission. Also, be aware of any different requirements based on whether the person is a resident or nonresident, as this might change the information you need to provide.

What should I do if I receive an audit notice related to my IRS 8840?

Upon receiving an audit notice regarding your IRS 8840, it's crucial to gather all requested documentation and understand the specifics of the audit. Respond within the designated timeframe, providing the necessary information to address the IRS’s inquiries, which can help resolve any issues effectively without delay.

What common mistakes should I watch out for when filing IRS 8840?

Common errors in filing IRS 8840 include incorrect Social Security numbers, missing signatures, or failing to include necessary declarations. Double-checking your form for accuracy and completeness before submission can help prevent these issues. Familiarizing yourself with the common pitfalls is also a smart way to streamline your filing process.

See what our users say