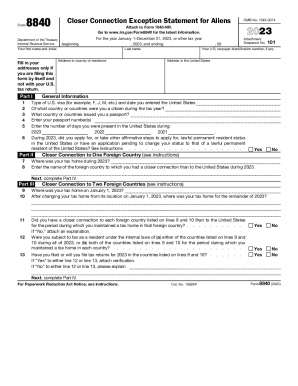

IRS 8840 2024-2025 free printable template

Show details

Return mail Form 8840 to the Revenue Service Center Austin TX 73301-0215 by the due date including extensions for filing Form 1040-NR. Penalty for Not Filing Form If you do not timely file Form 8840 you will not be eligible to claim the closer treated as a U.S. resident. The substantial presence test you must file Form 8840 with the IRS to establish your claim that you are a nonresident of exception. Each alien individual must file a separate Form 8840 to claim the closer connection...

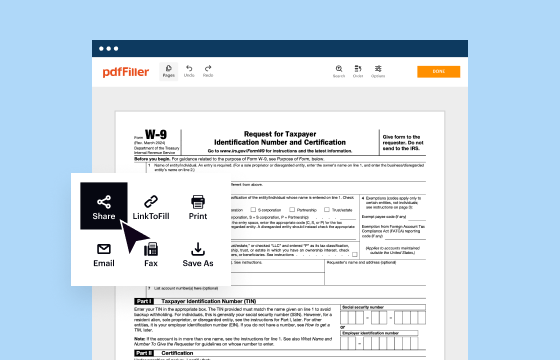

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 8840

Step-by-Step Guide to Editing Your Form 8840

Guide to Completing IRS Form 8840

Understanding and Utilizing IRS Form 8840

IRS Form 8840, also known as the "Closer Connection Exception Statement for Aliens," is a critical document for individuals who meet specific criteria and wish to establish their tax residency status in the United States. This form helps non-resident aliens claim exemptions from U.S. tax obligations based on their closer connection to a foreign country. Understanding this form not only helps taxpayers comply with U.S. tax laws but also enables them to take advantage of applicable exemptions.

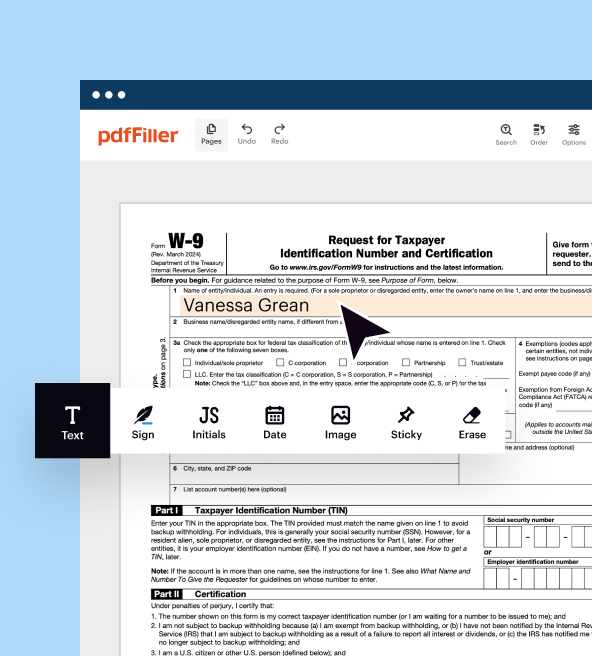

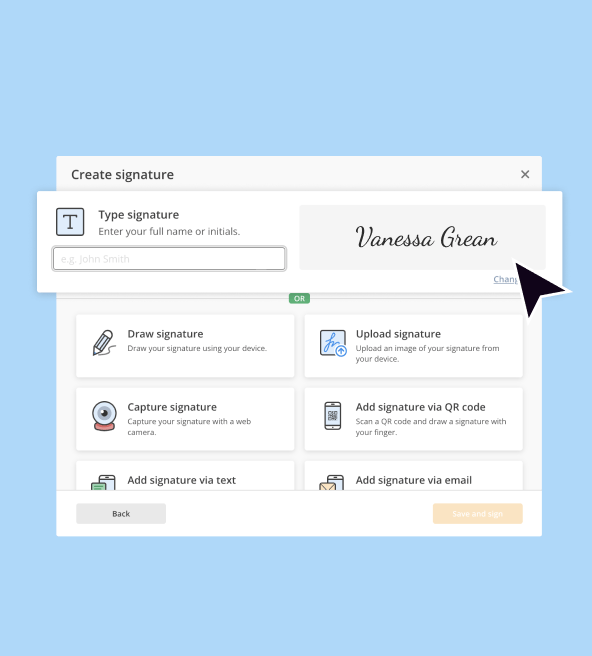

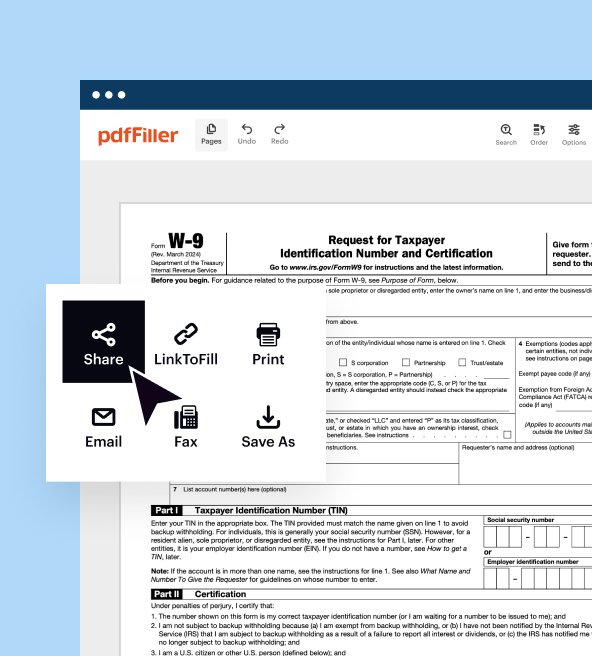

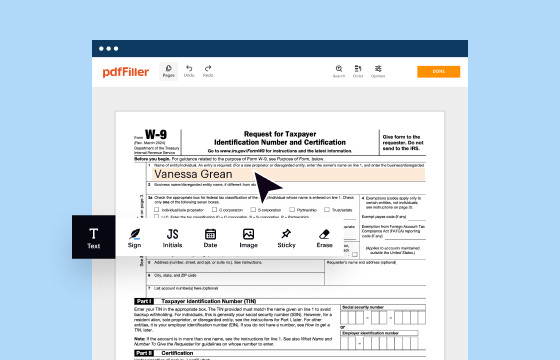

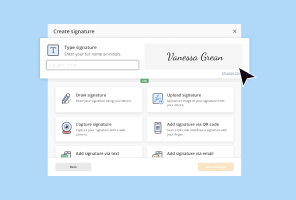

Step-by-Step Guide to Editing Your Form 8840

Editing your IRS Form 8840 requires careful attention to detail to ensure all information is accurate and complete. Follow these steps:

01

Review personal information: Verify that your name, taxpayer identification number, and address are correctly listed.

02

Check residency status: Ensure that you appropriately indicate your residency status and the applicable years.

03

Evaluate connections: Clearly outline your significant connections to your home country—this can include the location of your permanent home and family ties.

04

Proofread: Check for typographical errors and ensure clarity in your descriptions. A clean form improves processing time.

05

Save and store: Keep an electronic and printed copy for your records before submission.

Guide to Completing IRS Form 8840

To complete Form 8840 effectively, follow these essential instructions:

01

Begin with personal information: Enter your full name, address, and taxpayer identification number at the top of the form.

02

Explain your closer connection: Provide comprehensive details on why you consider your primary connections to be outside the U.S. Include documentation whenever possible.

03

Identify residential ties: Document where your family resides, your personal belongings, and the frequency of your visits to the U.S.

04

Declare exceptions: If you qualify for any exemptions under IRS guidelines, be sure to indicate them clearly on the form.

05

Verify your information: Double-check all entries for accuracy before submission.

Show more

Show less

Latest Updates and Changes Regarding IRS 8840

Latest Updates and Changes Regarding IRS 8840

Tax regulations and requirements frequently update, and recent changes to IRS Form 8840 can significantly affect your filing process:

01

New reporting guidelines as of 2023 require additional documentation regarding foreign income sources.

02

The income threshold for filing has been adjusted, impacting who qualifies for the exemption.

03

Clarifications in the definition of "closer connection" may affect how taxpayers establish and document their ties to foreign countries.

Essential Insights into IRS Form 8840

Defining IRS Form 8840

The Purpose Behind IRS Form 8840

Who is Required to Complete IRS Form 8840?

When Does an Exemption Apply?

What Components Constitute IRS Form 8840?

Important Deadlines for Filing IRS Form 8840

A Comparative Look at IRS Form 8840 and Similar Documents

Transactions Covered by IRS Form 8840

Number of Copies Needed for Submission

Consequences of Failing to Submit IRS Form 8840

Information Needed for Filing IRS Form 8840

Additional Forms Accompanying IRS Form 8840

Where to Send Your Completed IRS Form 8840

Essential Insights into IRS Form 8840

Defining IRS Form 8840

IRS Form 8840 is designed for non-resident aliens who seek to claim an exemption from being classified as a U.S. tax resident based on their closer connections to another country. This form is crucial for preventing dual taxation and ensuring compliance with tax obligations.

The Purpose Behind IRS Form 8840

The purpose of IRS Form 8840 is twofold: it allows taxpayers to assert their claim for tax residency exemption and helps the IRS determine their tax obligations accurately. By filing this form, you clarify your tax residency status and minimize risk of tax penalties.

Who is Required to Complete IRS Form 8840?

Individuals who should file Form 8840 include:

01

Non-resident aliens in the U.S. for a prolonged period who maintain significant ties to their home country.

02

Individuals who meet the substantial presence test but are seeking exemptions due to a closer connection to a foreign country.

When Does an Exemption Apply?

Exemptions outlined in Form 8840 may apply when taxpayers meet specific conditions, such as:

01

Having a permanent home available in a foreign country while spending limited time in the U.S.

02

Maintaining a family residing in the foreign country.

03

Having a job or business that ties you to your home country, such as owning a business or working for a foreign employer.

What Components Constitute IRS Form 8840?

Form 8840 comprises several sections, including:

01

Personal identification information.

02

Details regarding your residency and closer connection status.

03

Information about your time spent in the U.S. versus your home country.

Important Deadlines for Filing IRS Form 8840

IRS Form 8840 must be filed by the due date of your income tax return for the year in question. For most individuals, this is April 15. Failure to file on time may result in penalties and complications with your tax status.

A Comparative Look at IRS Form 8840 and Similar Documents

IRS Form 8840 should not be confused with other similar forms, such as Form 1040NR (U.S. Non-Resident Alien Income Tax Return) which is filed to report income. In contrast, Form 8840 is focused specifically on residency status and exemptions.

Transactions Covered by IRS Form 8840

This form does not directly cover specific transactions but is essential in establishing residency for those engaged in activities that could lead to U.S. taxation, such as owning property or conducting business transactions within the U.S.

Number of Copies Needed for Submission

Typically, only one signed copy of IRS Form 8840 is required for submission. However, it is advisable to keep additional copies for your records and future reference.

Consequences of Failing to Submit IRS Form 8840

Failure to submit IRS Form 8840 can result in various penalties, including:

01

Financial penalities ranging from frustration with delayed processing of tax returns to potential tax liabilities.

02

Legal repercussions, such as audits or additional inquiries from the IRS regarding your tax status.

Information Needed for Filing IRS Form 8840

When preparing to file Form 8840, ensure you gather the following information:

01

Your current and previous tax residency status.

02

Details of your connections to both the U.S. and your home country.

03

Documentation supporting your claims of a closer connection.

Additional Forms Accompanying IRS Form 8840

If applicable, you may need to file supporting documentation or additional forms, such as Form 1040NR, to clarify your income reporting while establishing your non-residency.

Where to Send Your Completed IRS Form 8840

Submit your completed IRS Form 8840 to the address specified in the form instructions, typically to a designated processing center based on your geographical location. Make sure to send it via a traceable mailing method to ensure delivery confirmation.

Understanding IRS Form 8840 is essential for non-resident aliens aiming to claim tax exemptions in the U.S. For further assistance with your tax preparation or to begin filling out your form, consider reaching out to a tax professional or using resources that simplify the IRS filing process.

Show more

Show less

Try Risk Free